Your First tech refinance rates images are available in this site. First tech refinance rates are a topic that is being searched for and liked by netizens now. You can Get the First tech refinance rates files here. Download all royalty-free photos and vectors.

If you’re searching for first tech refinance rates images information related to the first tech refinance rates topic, you have come to the right blog. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

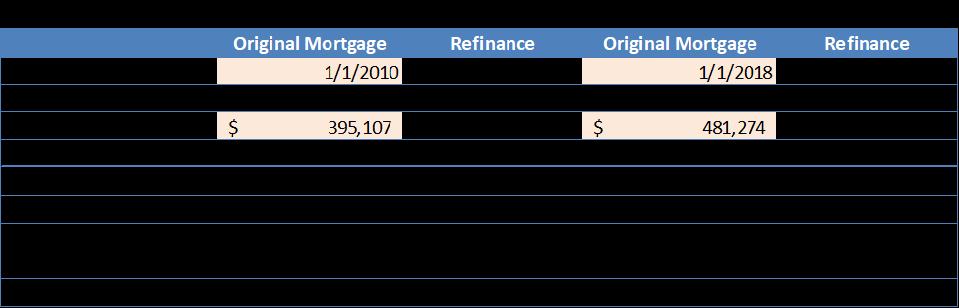

First Tech Refinance Rates. With a 155000 refinance your monthly payment would be 110807. Minimum opening deposit1 cent. The APR ranges from Prime Rate to Prime Rate 150. If you initially get a mortgage with a rate of 5 and learn you can refinance to a mortgage with a rate of 4 you might decide its worth the cost and trouble of refinancing to nab that lower rate.

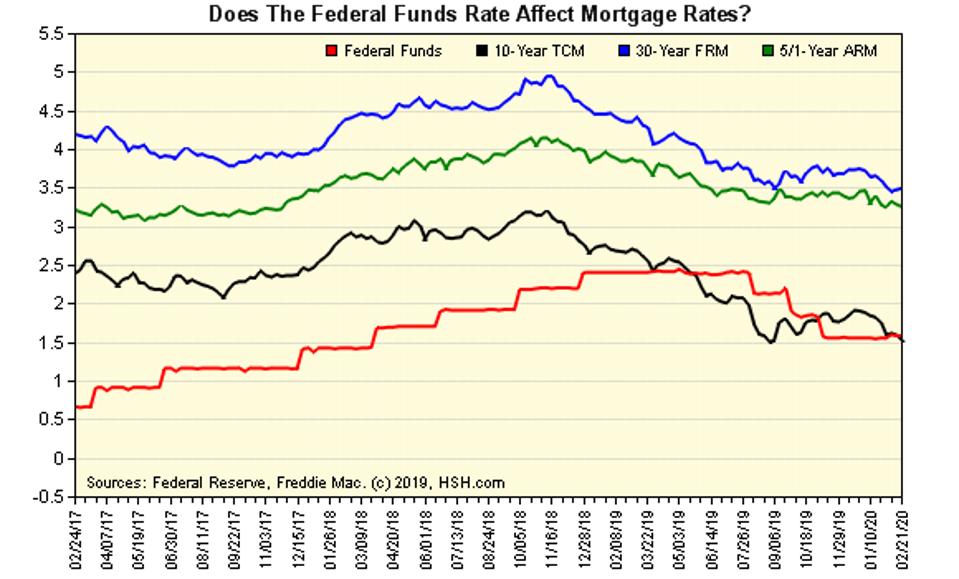

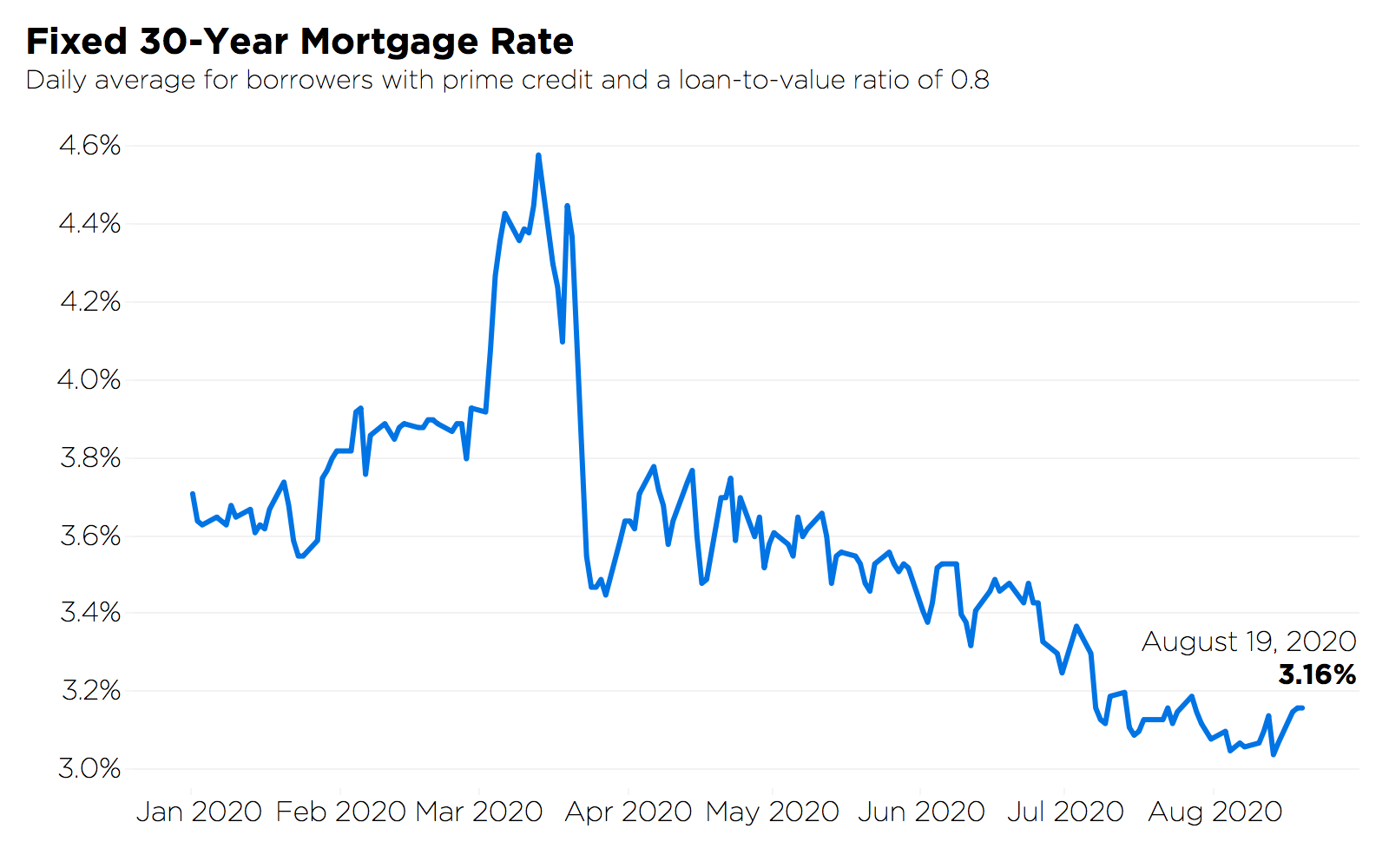

With Mortgage Rates So Low Is Now A Good Time To Refinance From forbes.com

With Mortgage Rates So Low Is Now A Good Time To Refinance From forbes.com

Monthly account maintenance feeNone. The APR ranges from Prime Rate to Prime Rate 150. With a First Tech auto loan not only do you get a competitive rate we also offer same day financing no payments for up to 90 days and no fees. Like many banks and credit unions First Tech doesnt offer a rate discount for setting up automatic payments. Each lender will follow roughly the same steps when assessing your application. Fixed Rate Home Equity Loans.

First Tech Mortgage Rates Today Applying for a home equity loan is similar but easier than applying for a new mortgage.

If you refinance student loans with First Tech Federal Credit Union youll get the following perks. For the 150000 refinance your monthly payment would be 107232 including principal and interest. With a 155000 refinance your monthly payment would be 110807. If you initially get a mortgage with a rate of 5 and learn you can refinance to a mortgage with a rate of 4 you might decide its worth the cost and trouble of refinancing to nab that lower rate. First Tech Federal Credit Union. The main reason to take out a home equity loan is that it offers a cheaper way of.

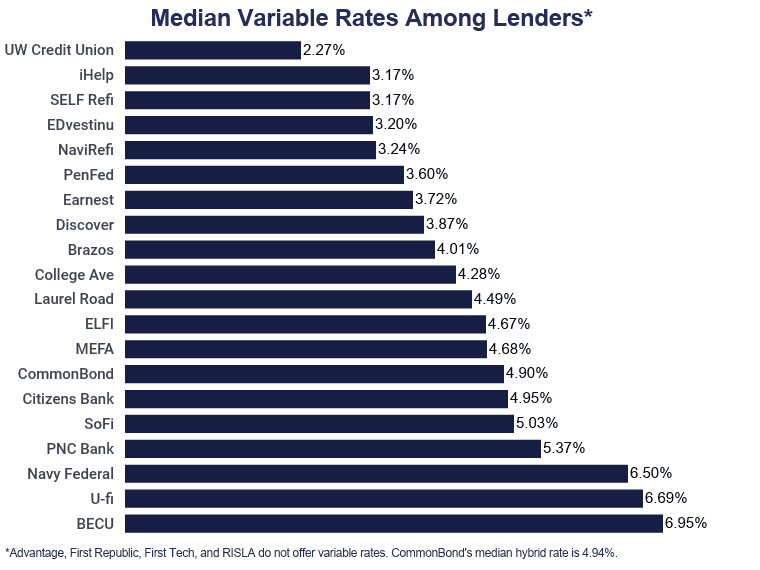

Source: nerdwallet.com

Source: nerdwallet.com

First Tech Federal Credit Unions CD is known as a Share Certificate. Now could be a good time to revisit your mortgage and see if refinancing makes sense. Fee to use. For the 150000 refinance your monthly payment would be 107232 including principal and interest. First Tech Federal Credit Union.

Source: educationdata.org

Source: educationdata.org

With a First Tech auto loan not only do you get a competitive rate we also offer same day financing no payments for up to 90 days and no fees. Refinance your non-First Tech auto loan with us and put some extra money back into your pocket. Each lender will follow roughly the same steps when assessing your application. The APR ranges from Prime Rate to Prime Rate 150. Monthly account maintenance feeNone.

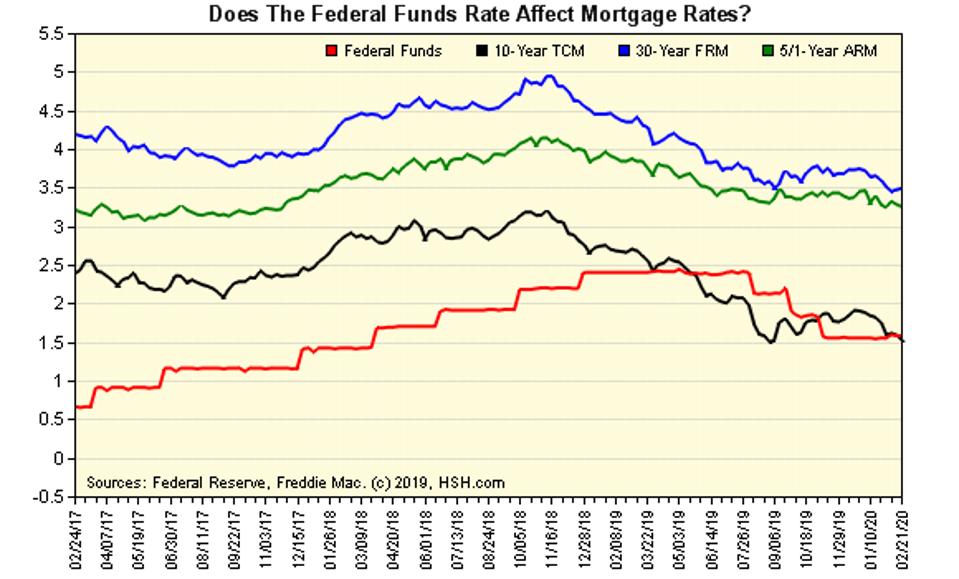

Source: forbes.com

Source: forbes.com

No First Tech Federal Credit Union Student Loan Refinancing does not charge a loan origination fee. First Tech Federal Credit Union. 100 when you open a First Tech Dividend Rewards. On March 31 2021 the Prime Rate was 325. We have provided this link for your convenience.

Source: firsttechfed.com

Source: firsttechfed.com

Refinance your non-First Tech auto loan with us and put some extra money back into your pocket. Rate Payments - find the right loan product for you a personalized rate and payment quote. A loan origination fee is what some lenders charge for processing underwriting and funding a loan. First Tech Federal Credit Union. This rate discount is usually between 025.

Source: forbes.com

Source: forbes.com

No rate discount for automatic payments. First tech is a federal credit union and caps interest rates at 18. Minimum loan amount is 10000 and maximum of 250000. Youll earn a fixed rate with these certificates with an APY between 015 and 055. Your rate will not exceed 1800 APR.

Source: firsttechfed.com

Source: firsttechfed.com

First Tech Mortgage Rates It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. Here are the rates for some of our most popular programs. A fixed CommonBond MBA Loan with an APR of 620 which is based on the median rate 616 and an origination fee of 2 A fixed Grad PLUS Loan with an APR of 742 which is based on the 2019-2020 federal Grad PLUS interest rate of 708 and an origination fee of 4236. 025 off auto loan rates at First Tech. If you need to clear your credit card or pay off loans with other financial institutions you can pay it all off at once with our refinance loan for as little as 856 APR 89.

Source: zillowgroup.com

Source: zillowgroup.com

Making minimum interest-only payments will not pay down your principal. With a First Tech auto loan not only do you get a competitive rate we also offer same day financing no payments for up to 90 days and no fees. ATM fee2 for each out-of-network ATM use plus ATM surcharge fees from the ATMs owner. A fixed CommonBond MBA Loan with an APR of 620 which is based on the median rate 616 and an origination fee of 2 A fixed Grad PLUS Loan with an APR of 742 which is based on the 2019-2020 federal Grad PLUS interest rate of 708 and an origination fee of 4236. You may require a loan for different life events - holidays house refurbishment car purchase etc.

Source: firsttechfed.com

Fixed Rate Home Equity Loans. First Tech Mortgage Rates It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. Typically fees range from 05 to 5 of the loan amount. Here are the rates for some of our most popular programs. Minimum opening deposit1 cent.

If you need to clear your credit card or pay off loans with other financial institutions you can pay it all off at once with our refinance loan for as little as 856 APR 89. With rates as low as 230 APR based on state of residency the timing couldnt be better. At First Tech Credit Union we encourage you to manage your money carefully by structuring loans around your needs and your ability to. With a First Tech auto loan not only do you get a competitive rate we also offer same day financing no payments for up to 90 days and no fees. There is a 10-year draw period with 15-year repayment term.

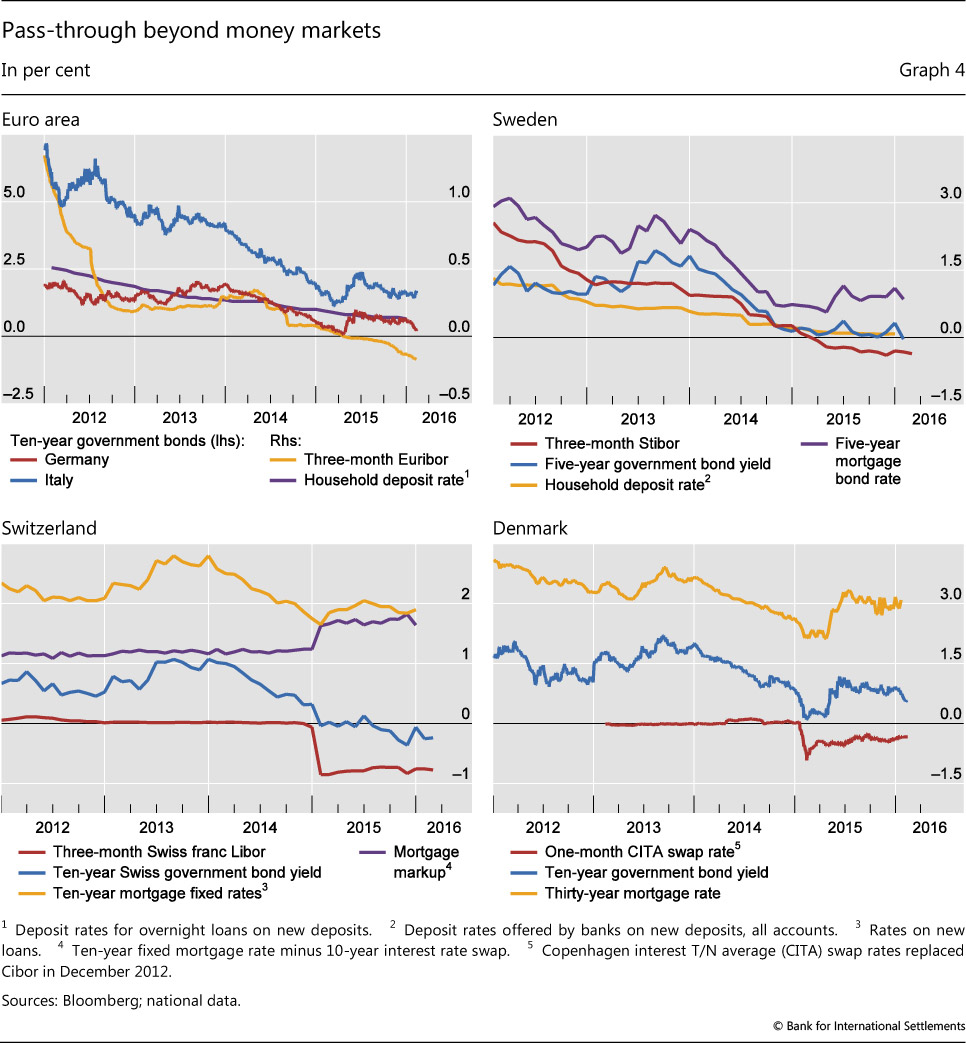

Source: bis.org

Source: bis.org

With rates as low as 230 APR based on state of residency the timing couldnt be better. First Tech Federal Credit Unions CD is known as a Share Certificate. You can lock-in up to three fixed-rate loans under one line of credit. Monthly account maintenance feeNone. First Tech Federal Credit Union.

This rate discount is usually between 025. Making minimum interest-only payments will not pay down your principal. Each lender will follow roughly the same steps when assessing your application. Your first fixed rate lock is free each additional rate-lock is 25. No rate discount for automatic payments.

We have provided this link for your convenience. First Tech Federal Credit Union. First Tech Mortgage Rates It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition. If you initially get a mortgage with a rate of 5 and learn you can refinance to a mortgage with a rate of 4 you might decide its worth the cost and trouble of refinancing to nab that lower rate. Refinance your non-First Tech auto loan with us and put some extra money back into your pocket.

Minimum loan amount is 10000 and maximum of 250000. You can lock-in up to three fixed-rate loans under one line of credit. Each lender will follow roughly the same steps when assessing your application. 100 when you open a First Tech Dividend Rewards. The lender will ask you for much of the same information as it would when applying for Mortgage On 600k a mortgagesuch as access to your credit score and income statements.

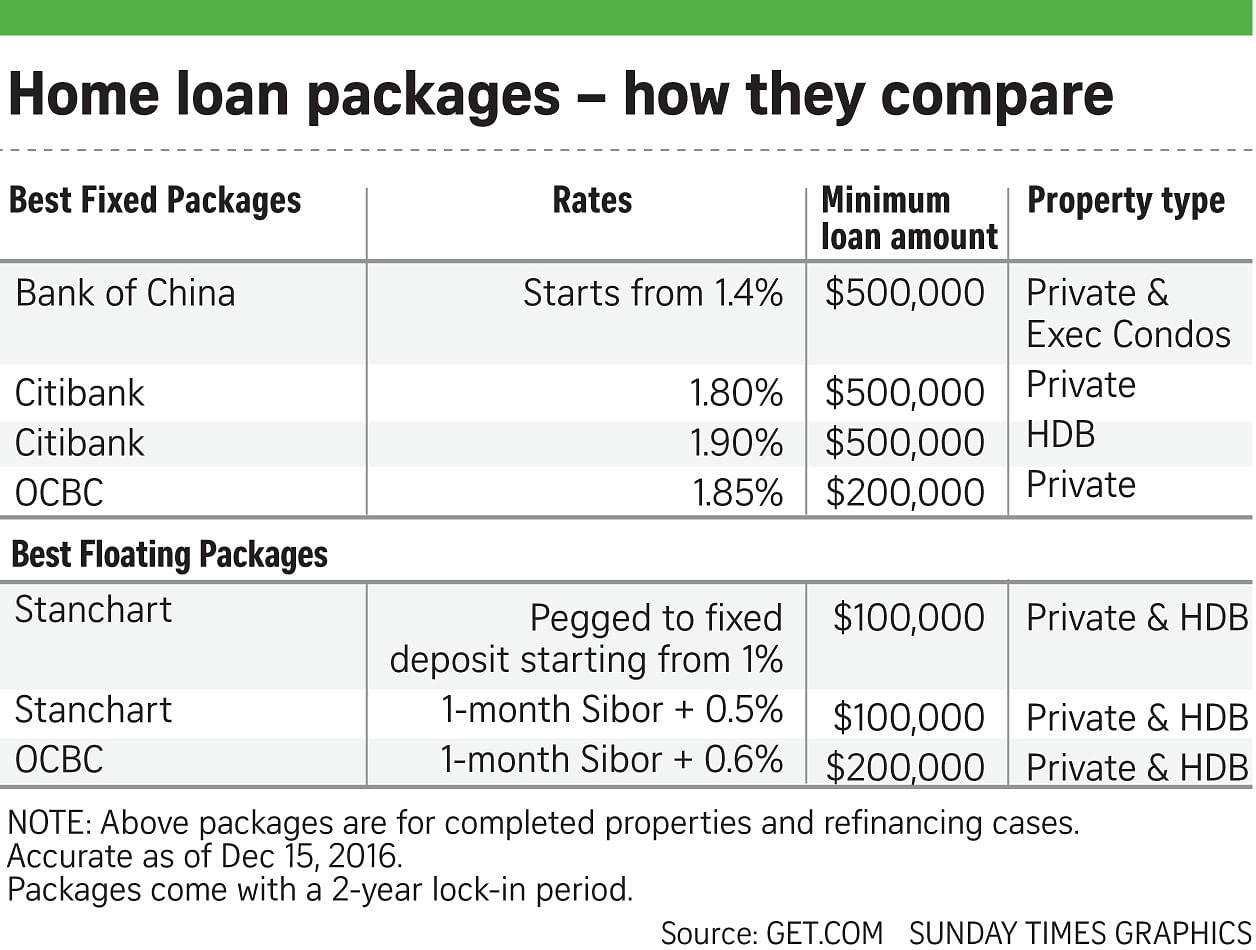

Source: homeanddecor.com.sg

Source: homeanddecor.com.sg

A fixed CommonBond MBA Loan with an APR of 620 which is based on the median rate 616 and an origination fee of 2 A fixed Grad PLUS Loan with an APR of 742 which is based on the 2019-2020 federal Grad PLUS interest rate of 708 and an origination fee of 4236. If you need to clear your credit card or pay off loans with other financial institutions you can pay it all off at once with our refinance loan for as little as 856 APR 89. Rate Payments - find the right loan product for you a personalized rate and payment quote. This rate discount is usually between 025. For the 150000 refinance your monthly payment would be 107232 including principal and interest.

Source: firsttechfed.com

Source: firsttechfed.com

The main reason to take out a home equity loan is that it offers a cheaper way of. There is a 10-year draw period with 15-year repayment term. With a First Tech auto loan not only do you get a competitive rate we also offer same day financing no payments for up to 90 days and no fees. The lender will ask you for much of the same information as it would when applying for Mortgage On 600k a mortgagesuch as access to your credit score and income statements. On March 31 2021 the Prime Rate was 325.

There is a 10-year draw period with 15-year repayment term. First Tech Federal Credit Unions CD is known as a Share Certificate. First Tech Mortgage Rates Today Applying for a home equity loan is similar but easier than applying for a new mortgage. First Tech Federal Credit Union. There is a 10-year draw period with 15-year repayment term.

Source: foxbusiness.com

Source: foxbusiness.com

On March 31 2021 the Prime Rate was 325. No lender fees Apply Online or with a Mortgage Consultant. Over 10000 if you meet requirements A lower APY will be applied if you dont meet the qualifications for the rates above. You can lock-in up to three fixed-rate loans under one line of credit. First Tech Mortgage Rates It is recommended for financing major one-off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition.

First tech is a federal credit union and caps interest rates at 18. Minimum loan amount is 10000 and maximum of 250000. With a 155000 refinance your monthly payment would be 110807. If you refinance student loans with First Tech Federal Credit Union youll get the following perks. Your rate will not exceed 1800 APR.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first tech refinance rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.