Your Texas tech credit union loan rates images are available in this site. Texas tech credit union loan rates are a topic that is being searched for and liked by netizens now. You can Get the Texas tech credit union loan rates files here. Find and Download all free vectors.

If you’re looking for texas tech credit union loan rates pictures information connected with to the texas tech credit union loan rates interest, you have come to the ideal site. Our website frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Texas Tech Credit Union Loan Rates. All loans are subject to credit approval and Credit Union of Texas lending policies. APR New Car - 36 Mo. Refinanced Tech CU home equity line of credit loans requires 10000 credit line increase to be considered for introductory rate. Stay up-to-date on industry news and happenings that may impact your loan like a change in mortgage interest rates.

Why To Hassle While Visiting The Banks When Money Can Come To Your Door Doorstep Loans From Loan Bank Delivers Cash At Your H Instant Money Loan The Borrowers From nl.pinterest.com

Why To Hassle While Visiting The Banks When Money Can Come To Your Door Doorstep Loans From Loan Bank Delivers Cash At Your H Instant Money Loan The Borrowers From nl.pinterest.com

Use this calculator to help you determine your monthly car loan payment or your car purchase price. Refinanced Tech CU home equity line of credit loans requires 10000 credit line increase to be considered for introductory rate. Easily access contact information for your Texas Tech Credit Union Mortgage Loan Officer and real estate agent and share this information with your family and friends. 3 - Rate discounts - Members may be eligible for the following rate discounts. New Used Auto Loan Rates. Tech CU loan refinances are not eligible.

RV Boat Motorcycle Rates.

Contact the Main Officelocation at 1802 Texas Tech Parkway by calling 806 742-3606 or contact the credit union by any of these means. Loans Toll Free 800 592-3328 CEFCU Routing 322280692 If you are using a screen reader or other auxiliary aid and are having problems using this website please call 1-800-592-3328 and choose option 3 for assistance Monday-Friday from 800 am. All loans are subject to credit approval and Credit Union of Texas lending policies. Texas Tech Credit Union is here to help with all your banking needs. A sample loan payment for a fixed equity loan based on a. Easily access contact information for your Texas Tech Credit Union Mortgage Loan Officer and real estate agent and share this information with your family and friends.

Source: pinterest.com

Source: pinterest.com

Based on a 25000 auto loan amount the minimum monthly payment is 54227 over a 48-month loan at 199 APR. ALLIANCE Credit Union in Lubbock Texas offers valuable banking solutions including checking accounts savings accounts certificates IRAs mortgages personal loans business loans and more. Texas Tech Credit Union is here to help with all your banking needs. Contact the Main Officelocation at 1802 Texas Tech Parkway by calling 806 742-3606 or contact the credit union by any of these means. Bank online with our mobile app or visit one of our conveniently located branches in Lubbock Texas.

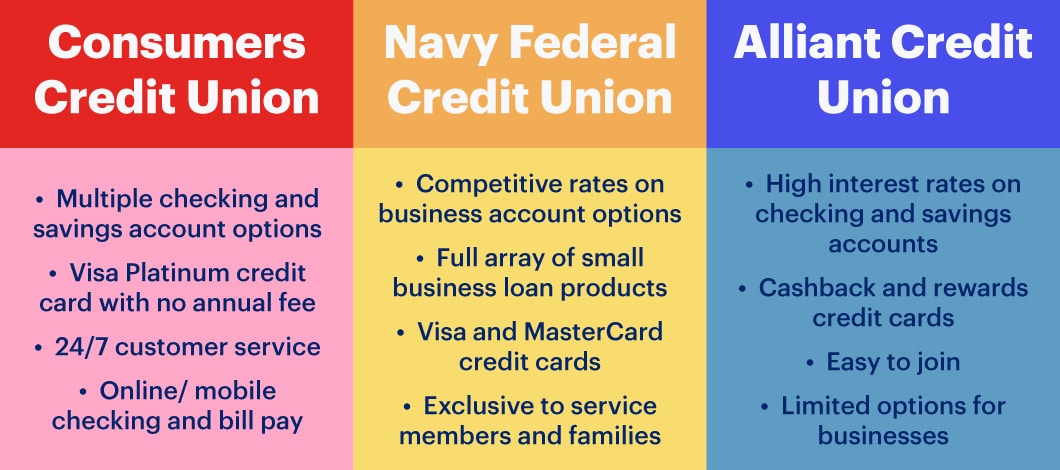

Source: money.com

Source: money.com

20 for military veterans educators and first responders. Minimum loan amount is 10000 and maximum of 250000. Loan application must be taken between April 1 2021 and May 31 2021. RV Boat Motorcycle Rates. There is a 10-year draw period with a 15-year repayment term.

Source: nl.pinterest.com

Source: nl.pinterest.com

Contact Texas Tech Federal Credit Union. Other restrictions may apply. Tech CU loan refinances are not eligible. Save thousands over the life of your mortgage loan by choosing a credit union for your home financing needs. APR New Car - 36 Mo.

Source: pinterest.com

Source: pinterest.com

RV Boat Motorcycle Rates. Contact the Main Officelocation at 1802 Texas Tech Parkway by calling 806 742-3606 or contact the credit union by any of these means. Based on a 25000 auto loan amount the minimum monthly payment is 54227 over a 48-month loan at 199 APR. Rate shown requires auto debit of monthly payment. Membership in a credit union in TX gives you distinct advantages over opening an account at a for-profit bank which includes the ability to earn dividends and enjoy lower loan rates and higher savings rates.

Source: pinterest.com

Source: pinterest.com

We will lend up to 8999 of the appraised home value less any first mortage balance. Rate is 324 APR without auto debit. APR New Car - 36 Mo. Contact the Main Officelocation at 1802 Texas Tech Parkway by calling 806 742-3606 or contact the credit union by any of these means. Minimum loan amount of 5000 required for 36 month term.

Source: badcredit.org

Source: badcredit.org

Contact Texas Tech Federal Credit Union. We will lend up to 8999 of the appraised home value less any first mortage balance. All loans are subject to credit approval and Credit Union of Texas lending policies. Contact the Main Officelocation at 1802 Texas Tech Parkway by calling 806 742-3606 or contact the credit union by any of these means. You can also examine your complete amortization schedule by clicking on the View Report button.

Source: in.pinterest.com

Source: in.pinterest.com

Use this calculator to help you determine your monthly car loan payment or your car purchase price. Rate shown requires auto debit of monthly payment. Membership in a credit union in TX gives you distinct advantages over opening an account at a for-profit bank which includes the ability to earn dividends and enjoy lower loan rates and higher savings rates. A home equity loan lets you borrow up to 80 of your homes value minus what you owe on your mortgage. Other restrictions may apply.

Source:

Source:

Search for Credit Union Mortgage Loan Interest Rates in your Texas city. 3 - Rate discounts - Members may be eligible for the following rate discounts. There is a 10-year draw period with a 15-year repayment term. Search for Credit Union Mortgage Loan Interest Rates in your Texas city. Mortgage Loan interest rate data includes all Texas credit unions reporting rates for mortgage loans.

Source: thebalance.com

Source: thebalance.com

20 for military veterans educators and first responders. Contact Texas Tech Federal Credit Union. The APR ranges from Prime Rate to Prime Rate 150. Loan rates shown below are for cars trucks and SUVs. We offer amazing rates friendly service and cutting-edge technologies so you can bank anywhere anytime.

Contact Texas Tech Federal Credit Union. Mortgage Loan interest rate data includes all Texas credit unions reporting rates for mortgage loans. APR New Car - 36 Mo. After you have entered your current information use the graph options to see how different loan terms or down payments can impact your monthly payment. Minimum loan amount 10000 required for 48 - 60 month terms.

Source: nerdwallet.com

Source: nerdwallet.com

Use this calculator to help you determine your monthly car loan payment or your car purchase price. ALLIANCE Credit Union in Lubbock Texas offers valuable banking solutions including checking accounts savings accounts certificates IRAs mortgages personal loans business loans and more. We will lend up to 8999 of the appraised home value less any first mortage balance. New Used Auto Loan Rates. Loans Toll Free 800 592-3328 CEFCU Routing 322280692 If you are using a screen reader or other auxiliary aid and are having problems using this website please call 1-800-592-3328 and choose option 3 for assistance Monday-Friday from 800 am.

Source: moneyunder30.com

Source: moneyunder30.com

We will lend up to 8999 of the appraised home value less any first mortage balance. A home equity loan lets you borrow up to 80 of your homes value minus what you owe on your mortgage. Rate is 324 APR without auto debit. Minimum loan amount is 10000 and maximum of 250000. Search for Credit Union Mortgage Loan Interest Rates in your Texas city.

Source: fastcapital360.com

Source: fastcapital360.com

Loan application must be taken between April 1 2021 and May 31 2021. Minimum loan amount of 5000 required for 36 month term. Easily access contact information for your Texas Tech Credit Union Mortgage Loan Officer and real estate agent and share this information with your family and friends. Bank online with our mobile app or visit one of our conveniently located branches in Lubbock Texas. Texas Tech Credit Union is here to help with all your banking needs.

Source: investopedia.com

Source: investopedia.com

APR New Car - 36 Mo. Minimum loan amount of 5000 required for 36 month term. Certificate of Deposit Rates. Texas Mortgage Loan Rates in your city. Other restrictions may apply.

Source: nerdwallet.com

Source: nerdwallet.com

736 is the difference between the amount paid in interest between FAIRWINDS Credit Unions rate at 195 APR compared to 381 APR for the National market average over the life of a 25000 auto loan over 36 months. Loans Toll Free 800 592-3328 CEFCU Routing 322280692 If you are using a screen reader or other auxiliary aid and are having problems using this website please call 1-800-592-3328 and choose option 3 for assistance Monday-Friday from 800 am. Membership in a credit union in TX gives you distinct advantages over opening an account at a for-profit bank which includes the ability to earn dividends and enjoy lower loan rates and higher savings rates. Minimum loan amount of 5000 required for 36 month term. Minimum loan amount is 10000 and maximum of 250000.

Source: ar.pinterest.com

Source: ar.pinterest.com

736 is the difference between the amount paid in interest between FAIRWINDS Credit Unions rate at 195 APR compared to 381 APR for the National market average over the life of a 25000 auto loan over 36 months. 736 is the difference between the amount paid in interest between FAIRWINDS Credit Unions rate at 195 APR compared to 381 APR for the National market average over the life of a 25000 auto loan over 36 months. 20 for using our Auto Market Dealer network. Datatrac Great Rate Awards certify that deposit and loan rates outperform the market average for comparable products. After you have entered your current information use the graph options to see how different loan terms or down payments can impact your monthly payment.

Source: nrlfcu.org

Source: nrlfcu.org

Mortgage Loan interest rate data includes all Texas credit unions reporting rates for mortgage loans. Refinanced Tech CU home equity line of credit loans requires 10000 credit line increase to be considered for introductory rate. Based on a 25000 auto loan amount the minimum monthly payment is 54227 over a 48-month loan at 199 APR. Texas Tech Credit Union is here to help with all your banking needs. Loan rates shown below are for cars trucks and SUVs.

Source: bankrate.com

Source: bankrate.com

Contact the Main Officelocation at 1802 Texas Tech Parkway by calling 806 742-3606 or contact the credit union by any of these means. A home equity loan lets you borrow up to 80 of your homes value minus what you owe on your mortgage. All loans are subject to credit approval and Credit Union of Texas lending policies. Loan rates shown below are for cars trucks and SUVs. Use this calculator to help you determine your monthly car loan payment or your car purchase price.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title texas tech credit union loan rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.